AN INTRODUCTION

The Davyhurst Project is located approximately 120 km north west of Kalgoorlie, within the Tier 1 gold mining province of the eastern goldfields in Western Australia.

Ora Banda Mining’s (OBM) tenement package consists of 92 granted tenements covering an area of approximately 1,200 km2. This provides almost continuous coverage of approximately 130 strike kilometres of greenstone sequences prospective for gold as well as nickel sulphide and base metal mineralisation.

OBM Tenure & Simplified Geology

Ora Banda Mining is focused on unlocking significant value from our strategic and prospective landholding. To achieve this, the Company has targeted resource development activities at five advanced project areas: Riverina, Waihi, Siberia (Sand King and Missouri Deposits), Callion and Golden Eagle. This work cumulated in the delivery of a Definitive Feasibility Study (DFS), announced to the market on 30 June 2020.

The DFS confirmed development of the Davyhurst Project to be financially robust. Key outcomes include:

- Initial ~5.2-year mine life with first gold poured in Q1 CY2021

- 81koz per annum – average annual gold production

- A$68.8M – average annual free cash flow (at A$2,550/oz gold price)

The Davyhurst Project has significant pre-existing infrastructure in place including a 1.2 Mtpa conventional CIP processing facility, an extensive road network, 172-person camp, administration & workshop buildings and a large water bore field. This enabled a rapid, low capital pathway to production.

PROJECT LOCATION

The Davyhurst Project is centred on the historical Davyhurst townsite, which is located 120 km north west of Kalgoorlie. The tenement package is accessed from Kalgoorlie via Goldfields Highway and a series of well-formed, unsealed shire roads. Access to project areas on the tenure is provided by unsealed shire roads and haul roads. Airstrips are located at Davyhurst (Callion) and Riverina.

Project Location & Access

PROJECT HISTORY

Gold was discovered in the district in the 1890s by prospectors following greenstone belts northward from Coolgardie. Within the project area, mining towns were established at Callion, Davyhurst, Siberia, Ularring, Mulline, Copperfield and Mt Ida. Between 1890 and 1950, numerous small to medium scale underground mining operations were established within the project area with cumulative production of approximately 600,000 ounces of gold.

Modern exploration and mining in the district commenced in the mid-1980s. Since that time, numerous companies have conducted exploration or had production operations in a fragmented tenure environment covered by the current project area.

Consolidation of the disparate tenement holding was undertaken by OBM’s predecessor Monarch Gold Mining Ltd between 2002 and 2006. There has been no large-scale, coherent exploration undertaken on the project since this strategic tenement consolidation. The company has a unique opportunity to define the critical mass of resource and reserves across a large and under-explored tenure needed to create a long-term sustainable mining operation.

REGIONAL GEOLOGY

The Davyhurst Project is located on a western branch of the Norseman Wiluna Greenstone Belt. The Project straddles the boundary between the Kalgoorlie Terrane of the Eastern Goldfields Province and the Barlee Domain of the Southern Cross Province, which is defined by the crustal-scale Ida Lineament. The Project also includes portions of the Zuleika Shear which separates the Coolgardie and Ora Banda Domains within the Kalgoorlie Terrane.

The Barlee Domain, to the west of the Ida Lineament, comprises a sequence of banded iron formation (BIF), shale, chert, and basalt, all poorly outcropping against basement granites.

The Ida Lineament is a poorly defined structure, but is commonly interpreted to be along the western contact of the western most ultramafic unit as defined by aeromagnetic data. East of the Ida Lineament, greenstones of the Coolgardie and Ora Banda Domains consist of sedimentary and felsic volcanoclastic rocks to the west, and mafic to ultramafic volcanic rocks with lesser volumes of felsic rocks to the east. The Project is generally bounded by basement granite and gneiss terranes. Internal to the greenstone belt there are several granite intrusions of various ages. The most prominent of these granites is the Ularring Granite, located midway between the Davyhurst and Riverina area.

RESOURCES & RESERVES

Gold mineralisation is the principal target within the Project and occurs across all geological domains within the Project.

Bedrock gold mineralisation within the Project is structurally controlled and is generally associated with mafic and high-Mg volcanic and intrusive rocks.

Two principal deposit types are present:

– Brittle fracture quartz veining with associated biotite alteration and sulphide mineralisation.

– Lode style silica-biotite-pyrite altered shear zones with minor quartz veining.

Recent discovery of gold mineralisation adjacent to the mafic granite contact on the north west corner of the Ularring Granite at the Giles Deposit highlights the potential of further discoveries to be made on the margins of, or within granite bodies within the project area.

The Project has a mineral resource inventory of 2.00Moz @ 2.5g/t. The Company has defined mineral reserves inventory of 276koz @ 1.9g/t.

OBM Resource, Reserve and Historical Production. OBM’s top five projects highlighted in yellow

MINERAL RESOURCES

OBM - Global Mineral Resources

- The Missouri, Sand King, Riverina Area, British Lion, Waihi, Callion, Golden Eagle, Forehand and Silver Tongue Mineral Resources have been updated in accordance with all relevant aspects of the JORC code 2012, and initially released to the market on 15 December 2016 & 26 May 2020 (Missouri), 3 January 2017 & 26 May 2020 (Sand King), 2 December 2019 & 26 May 2020 (Riverina), 4 February 2020 (Waihi), 15 May 2020 & 29 June 2020 (Callion), 8 April 2020 (Golden Eagle) and 9 October 2020 (Riverina South).

- All Mineral Resources listed above, with the exception of the Missouri, Sand King, Riverina Area, British Lion, Waihi, Callion, Golden Eagle, Forehand and Silver Tongue Mineral Resources, were prepared previously and first disclosed under the JORC Code 2004 (refer Swan Gold Mining Limited Prospectus released to the market on 13 February 2013). These Mineral Resources have not been updated in accordance with JORC Code 2012 on the basis that the information has not materially changed since it was first reported.

- The Riverina Area, British Lion, Waihi, Sand King, Missouri, Callion, Forehand and Silver Tongue Open Pit Mineral Resource Estimates are reported within a A$2,400/oz pit shell above 0.5g/t. The Riverina Area, British Lion, Waihi, Sand King, Missouri, Callion, Forehand, Silver Tongue and Golden Eagle Underground Mineral Resource Estimates are reported from material outside a A$2,400 pit shell and above 2.0 g/t.

- Previously, Riverina South included Riverina South and British Lion Resources. Currently Riverina South is included in the Riverina Area Resources as it is contiguous with Riverina mineralisation. British Lion is now quoted separately.

- Resources are inclusive of in-situ ore reserves and are exclusive of surface stockpiles

- The values in the above table have been rounded.

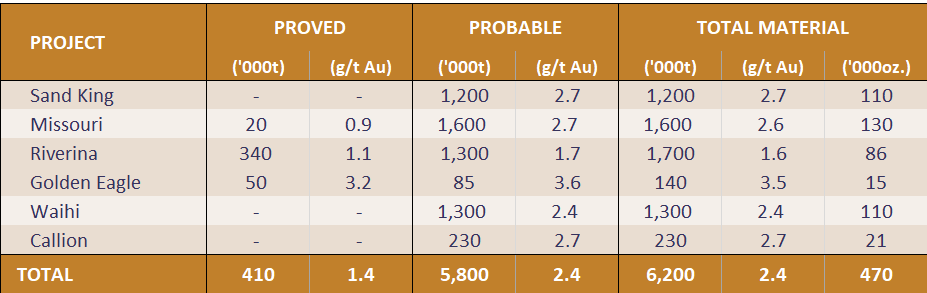

MINERAL RESERVES

OBM - Global Mineral Reserves

- The table contains rounding adjustments to two significant figures and does not total exactly.

- This Ore Reserve was estimated from practical mining envelopes and the application of modifying factors for mining dilution and ore loss.

- For the open pit Ore Reserve dilution skins were applied to the undiluted LUC Mineral Resource estimate at zero grade. The in-pit global dilution is estimated to be 31% at Sand King, 45% at Missouri, 24% at Riverina, 13% at Waihi and 26% at Callion all of which were applied at zero grade. The lower dilution at Riverina, Waihi and Callion reflecting the softer lode boundary and allows for inherent dilution within the lode wireframe. All Inferred Mineral Resources were considered as waste at zero grade.

- The Open Pit Ore Reserve was estimated using incremental cut-off grades specific to location and weathering classification. They range from 0.67 g/t to 0.80 g/t Au and are based on a price of A$2200 per ounce and include ore transport, processing, site overheads and selling costs and allow for process recovery specific to the location and domain and which range from 85% (Sand King fresh ore) to 95%.

- Approximately 100,000 t at 1.6 g/t at Riverina was downgraded from Proved to Probable due to current uncertainty surrounding reconciliations experienced during the implementation phase.

- The underground Ore Reserve was estimated from practical mining envelopes derived from expanded wireframes to allow for unplanned dilution. A miscellaneous unplanned dilution factor of 5% at zero grade was also included. The global dilution factor was estimated to be 52% with zero dilution grade.

- The underground Ore Reserve was estimated using stoping cut-off of 2.1 g/t Au which allows for ore drive development, stoping and downstream costs such as ore haulage, processing, site overheads and selling costs. An incremental cut-off grade of 0.66 g/t Au was applied to ore drive development and considers downstream costs only. Cut-off grades were derived from a base price of A$2200 per ounce and allow for process recovery of 92%.

- For Golden Eagle, approximately 35,000 t at 3.9 g/t of material was classified as Proved and derived from the Measured portion of the Mineral Resource. The balance of the Proved material was contained within surface stockpiles.

- The Ore Reserve is inclusive of surface stockpiles above the relevant incremental cut-off and total 370,000 t at 1.1 g/t. All surface stockpiles were classified as Proved.